How Winning Retailers Differ on IT Spend

The COVID-19 pandemic ushered in a once in a generation increase in the percentage of revenue that retailers spend on IT. Where retailers had already been increasing IT spend over the past decade, from 2019 to 2022 that percentage of revenue has jumped a full percentage point as retailers were forced to introduce and expand their ecommerce offerings. On average, we have seen the IT Spend as a factor of revenue increase 40-50% depending on the sector.

With that being said, there is a major difference in how different classes of retailers are spending their IT budget and the level in which they are investing. Just a few years ago, retailers estimated that about 80% of their spend was just to keep the lights on with existing systems and about 20% was available for new systems and innovation. In our latest research, the percentage for innovation doubles to 40% for GMS and Hospitality companies. Overall retailers report that only 63% of their budget is spent just maintaining and integrating existing systems and 37% is being spent on new systems and innovation. For winning retailers (retailers with sales growth of 10% or more), only 53% is being spend on existing systems for 2022 and 47% is available for innovation. This means that not only are winning retailers spending more on IT, but they are also spending considerably more on innovative IT spend and transforming their operations.

Nowhere is this difference more apparent than the comparison of winning retailers compared to below average retailers (flat or declining sales). Winning retailers are investing to make all of their digital journeys profitable where below average retailers are opening new stores at a rate 2x that of winning retailers, thus diluting their IT spend per store. In other words, below average retailers are spending considerably more of their IT spend on basic infrastructure spend for new stores, while winning retailers continue to build a firmer foundation from which to expand and growth their business.

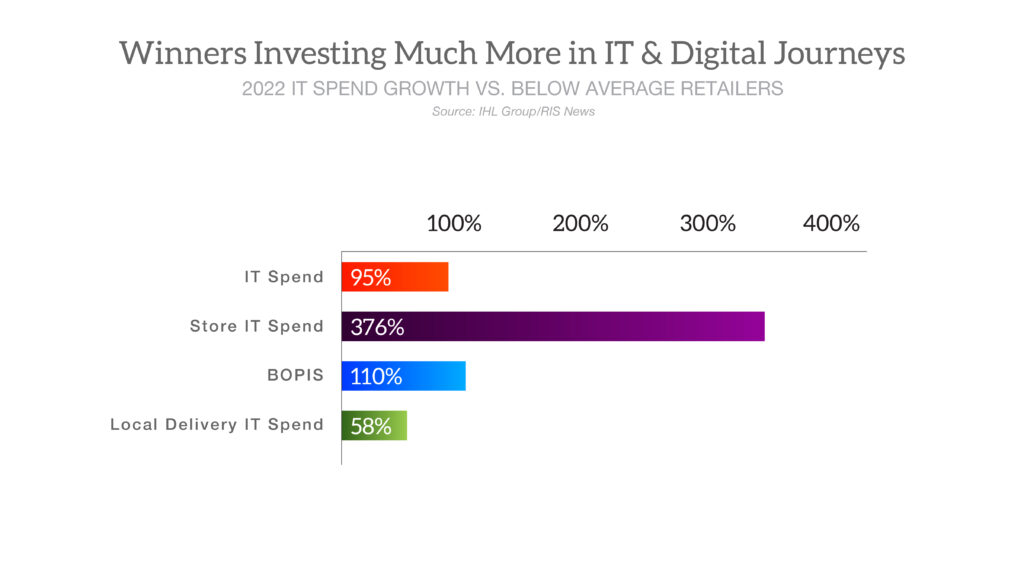

Let’s look at specifics. Winning retailers are growing their overall IT spend at a rate 95% higher than below average retailers. Once again, with double the number of stores (by percentage) opening among lower performing retailers, this 95% higher investment in IT spend equates to much higher transformational IT spend availability.

Winners are also investing much more in transforming their existing stores with IT spend growth that is 376% higher than below average retailers. Winners are totally transforming their stores by updating technologies like mobile devices, adding self-checkout, electronic shelf labels, mobile devices and more. They are investing heavily in technologies that optimize the scarce labor in the stores and are working to remove friction in the shopping process.

One of the biggest challenges that all retailers have faced is that the explosion of digital journeys has created a major margin problem for retailers. On average, retailers lose between 3 and 15 points of margin compared to a walk-in shopper when the consumer chooses Click and Collect, Ship from Store or Local Delivery. For this reason, winning retailers are heavily investing in all technologies that are reducing labor, reducing costs, and optimizing these journeys for profitability. In fact, they are growing their spend in BOPIS/Click and Collect-specific spend at a rate 110% higher than below average retailers. And when it comes to Local Delivery, the winners are growing IT spend at a level 58% higher than the below average performers in their sector.

So, the bottom line is that winning retailers not only spending more on IT, because of years of additional spend, they are light years ahead of their competitors on adding innovation to further extend their lead. They realize the labor shortage is not going away and the digital journeys are here to stay. They are investing at levels to completely transform their businesses for the decade ahead.

Content taken from Webinar “7 Technologies Winning Retailers Are Prioritizing” co-presented with Microsoft

This is a Microsoft sponsored blog

To learn more about Microsoft Cloud for Retail, please click here.